Protecting Your Finances: Understanding Check Washing Fraud

10/21/2024

At Grant County Bank, we are committed to your financial security and want to keep you informed about an increasing threat that could impact your business: Check Washing Fraud.

While many businesses have embraced electronic payments, some still prefer using paper checks for their transactions. If your business is one of them, it’s essential to understand the risks and know how to protect yourself.

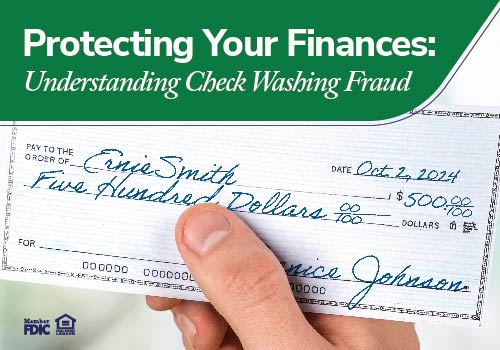

What is Check Washing Fraud?

Check washing is a type of fraud where criminals steal checks, use chemicals to erase the original details, and rewrite them with a new payee name and amount. This can result in unauthorized withdrawals from your account and significant financial losses if not detected promptly.

How Does Check Washing Happen?

Here’s how check washing typically works:

- Checks are Stolen: Thieves search for checks in mailboxes, outgoing mail, or unattended locations in offices.

- Checks are Washed: The original ink is washed away using common chemicals that don't damage the paper.

- Details are Rewritten: Fraudsters rewrite the payee name and the amount to benefit themselves.

- Checks are Cashed: The altered check is then cashed or deposited, resulting in unauthorized withdrawals from your account.

5 Proactive Steps Businesses Can Take to Protect Against Check Washing Fraud

- Implement Dual-Control Check Handling Procedures: Ensure that no single employee has full control over check writing and mailing. Assign different staff members to prepare checks and others to review and authorize them. This internal control reduces the risk of internal and external fraud.

- Use High-Security Checks and Inks: Switch to high-security checks that include multiple anti-fraud features such as watermarks, microprinting, and security threads. Consider using gel pens, which are less susceptible to washing than traditional ballpoint pens, to sign checks.

- Secure Your Check Storage and Mailing Processes: Store checks and checkbooks in locked, secure locations accessible only to authorized personnel. When mailing checks, use security envelopes and consider sending them via certified mail to ensure they reach the intended recipient securely.

- Monitor Bank Accounts Daily with Online Banking: Set up alerts for any checks clearing your account and review each transaction for unauthorized changes. Utilize online banking to quickly identify discrepancies such as altered check amounts or payees, enabling immediate action to stop fraud.

- Educate Employees on Fraud Prevention: Conduct regular training sessions for your team to help them recognize signs of check washing and other types of fraud. Ensure they know the procedures for reporting suspicious activity immediately, whether it's an altered check or an unfamiliar transaction.

Switch to Secure Online Banking Today

If you’re not yet using our online banking services, now is the time to make the switch. Our online banking platform is secure, easy to use, and helps you stay on top of your accounts without the risk of check washing. Plus, we offer free credit score monitoring and credit report reviews to help protect against identity theft.

We’re Here to Support You

Your financial safety is our top priority. If you have any questions or need help setting up online banking, reach out to your local branch or our main office. Our team is here and ready to assist you.

Stay Safe and Secure with Grant County Bank

As we continue to adapt to new threats in the financial world, staying informed is your first line of defense. Grant County Bank is here to provide the tools and support you need to protect your business from check washing and other types of fraud. Let’s work together to keep your finances secure.